Starting Restaurant Business in USA!

Ensuring compliance with legal rules when starting a restaurant in the USA is crucial to avoid costly penalties and potential shutdowns.

For instance, consider the case of “Bella Pasta,” an Italian restaurant in Boston. The owner, Marco, neglected to secure a proper health permit and failed to adhere to local food safety regulations. Shortly after opening, the restaurant faced a rigorous inspection by the local health department.

Due to multiple violations related to food handling and safety standards, “Bella Pasta” was temporarily closed, resulting in significant financial loss and damage to its reputation.

This situation highlights the importance of understanding and adhering to legal requirements. By following the necessary legal protocols, restaurant owners can ensure smooth operations and protect their investments from legal actions and fines that can jeopardize the business’s future.

In this article, you will learn 7 legal rules for starting restaurant business in USA.

1. Health and Safety Regulations

Restaurants must adhere to stringent health and safety standards set by local health departments, the state, and the U.S. Food and Drug Administration (FDA). These regulations cover everything from food storage temperatures to cleanliness of the premises and proper food handling techniques.

In New York City, the Health Department conducts unannounced inspections of restaurants and grades them on their adherence to health codes.

Regular training for staff on hygiene practices and staying updated with local health regulations can help maintain high standards and avoid penalties.

2. Licensing and Permits

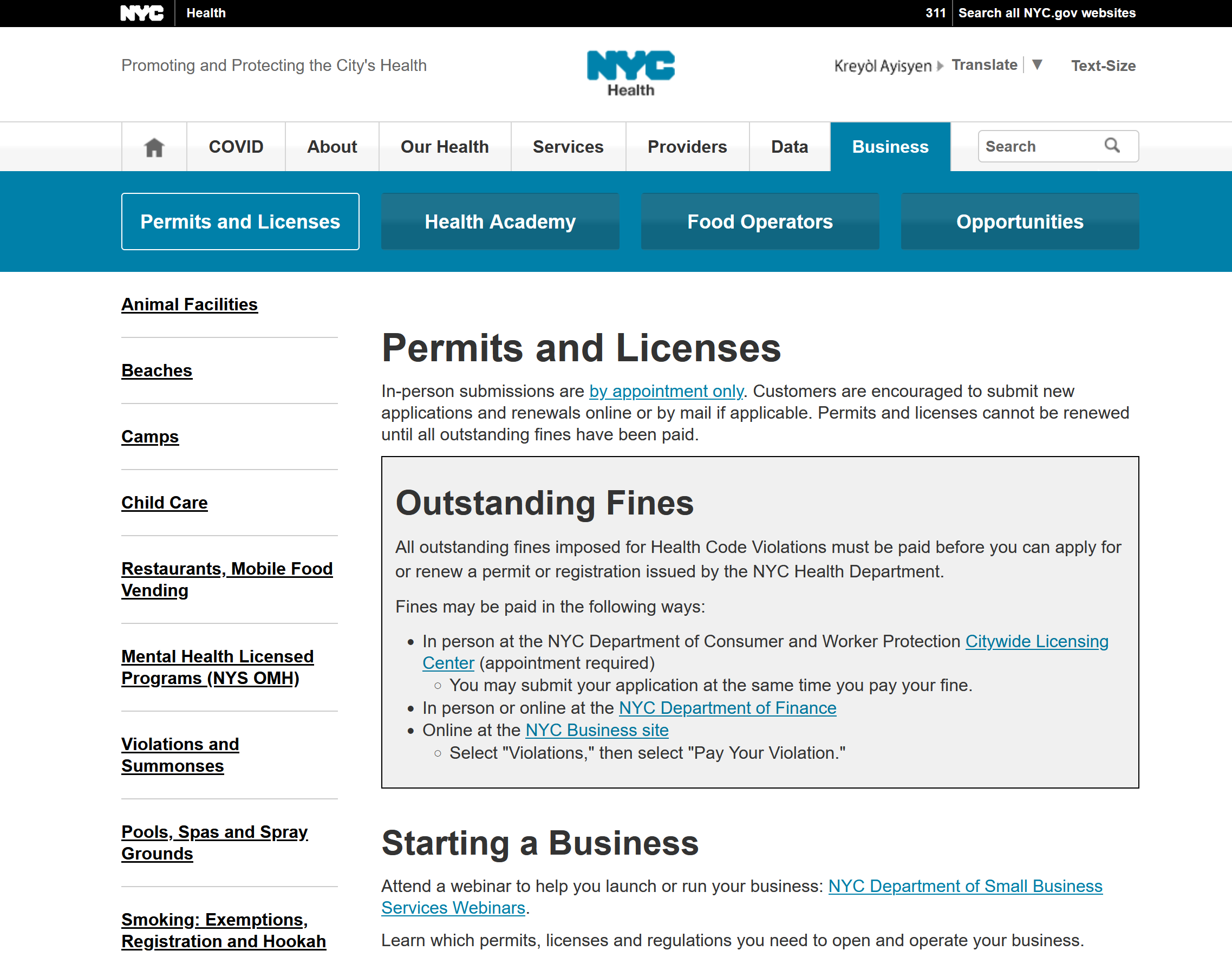

Obtaining the necessary licenses and permits is crucial before opening a restaurant. This includes a general business license, a food service establishment permit, and possibly a liquor license, which varies significantly from city to city.

In San Francisco, obtaining a liquor license can be competitive and expensive due to limited availability.

Start the application process early to ensure all necessary paperwork is approved before your planned opening. Using a professional service for navigating complex licensing can also be beneficial.

3. Labor Laws Compliance

Restaurants must adhere to federal and state labor laws covering minimum wage, overtime pay, employment eligibility, and non-discrimination. Tip allocation and management are also crucial areas, especially in cities with large hospitality industries like Las Vegas.

In Chicago, the minimum wage for non-tipped employees is higher than the federal minimum wage, affecting restaurant payroll planning.

Implement a reliable payroll system and keep transparent records to manage wages, tips, and hours worked. Regularly review changes in labor laws in your state.

4. Tax Obligations

Restaurants are responsible for collecting and remitting various taxes, including sales tax and meal taxes. Proper accounting for income and payroll taxes is also necessary.

Restaurants in Seattle must collect a sales tax that includes both state and city rates, which can be complex due to the different tax categories for food, beverages, and alcohol.

Use accounting software that can handle multiple tax rates and ensure regular updates for any changes in tax laws. Consulting with a tax professional can also help avoid legal issues.

5. Food Labeling and Consumer Protection Laws

Proper labeling, especially for potential allergens, is mandated to protect consumers. Misrepresentation in menus or advertising can also lead to lawsuits under consumer protection laws.

A restaurant in Boston might need to clearly label menu items that include shellfish or peanuts due to common allergies.

Train staff to be knowledgeable about the menu and ingredients so they can inform customers accurately. Regular audits of menu descriptions and marketing materials can prevent legal issues.

6. Building Codes and Zoning Laws

Restaurants must comply with local building codes and zoning regulations, which can influence everything from the size and layout of the kitchen to the customer seating area.

A restaurant in downtown Los Angeles must ensure proper ventilation systems are installed as per city requirements to avoid fines.

Consult with an architect or a city planner before signing leases or beginning renovations to ensure compliance with all local codes and regulations.

7. Privacy and Data Security Regulations

If a restaurant collects personal information, it must protect this data under laws like the California Consumer Privacy Act (CCPA), which affects any restaurant doing business in California.

A restaurant in San Diego offering online reservations must secure customers’ personal data to prevent data breaches.

Implement strong cybersecurity measures and ensure staff understand the importance of protecting customer data. Regularly review and update security protocols to keep up with new regulations.

By understanding and rigorously implementing these legal requirements, restaurant owners can avoid legal issues and focus on providing excellent food and service.