Starting a business can be overwhelming, and one of the biggest challenges is understanding when you’ll start making a profit. Many entrepreneurs struggle with this because they don’t know their breakeven point. Without this knowledge, you could be running your business at a loss without realizing it. But don’t worry, there’s a solution.

In this article, you will learn how to calculate the breakeven point in your business plan. By the end of this article, you’ll have a clear understanding of how to determine when your business will start generating profits.

What is the Breakeven Point?

The breakeven point is the moment when your business’s total revenues equal its total costs. This means you’re neither making a profit nor a loss. Understanding your breakeven point is crucial because it helps you set sales targets and pricing strategies. It’s a fundamental aspect of business planning that ensures you’re on the right track towards profitability.

Components of the Breakeven Point Calculation

To calculate your breakeven point, you need to understand three key components:

- Fixed Costs: These are expenses that remain constant regardless of your sales volume, such as rent, salaries, and insurance.

- Variable Costs: These costs vary directly with your production or sales volume, like raw materials and commission.

- Sales Price per Unit: This is the amount you charge your customers for one unit of your product or service.

Breakeven Point Formula

The formula for calculating the breakeven point is straightforward:

This formula shows the number of units you need to sell to cover all your costs.

Step-by-Step Calculation

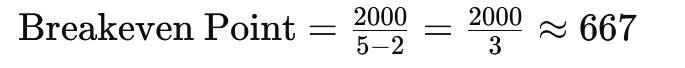

Let’s go through a practical example. Imagine you run a bakery. Your fixed costs are $2,000 per month, your variable costs per loaf of bread are $2, and you sell each loaf for $5.

Using the formula:

You need to sell approximately 667 loaves of bread each month to break even.

Download Excel File – Only for educational purposes.

Benefits of Knowing Your Breakeven Point

Knowing your breakeven point offers several benefits:

- Decision-Making: It helps you make informed decisions about pricing and cost management.

- Risk Management: By understanding how changes in costs and sales affect your profitability, you can better manage risks.

- Financial Planning: It aids in setting realistic sales targets and financial goals.

Common Mistakes and How to Avoid Them

Avoid these common mistakes to ensure an accurate breakeven analysis:

- Misunderstanding Fixed and Variable Costs: Ensure you correctly classify your costs.

- Incorrect Sales Price Estimation: Base your sales price on thorough market research.

- Ignoring External Factors: Consider factors like market trends and economic conditions that can impact your costs and sales.

In this article, we’ve covered the essentials of calculating the breakeven point in your business plan. Understanding this concept is vital for setting achievable sales targets and steering your business towards profitability. Now, take what you’ve learned and apply it to your business plan.

You’ll be better prepared to make strategic decisions and achieve your business goals.